capital gains tax increase effective date

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of. If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept.

. This resulted in a 60 increase in the capital gains tax collected in 1986. The 1987 capital gains tax collections were slightly below 1985. 13 2021 unless pursuant to a written binding contract effective on or before Sept.

Election platform the ndp proposed to increase. On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and by 40 in 2012 in anticipation of the increased maximum tax rate from 15 to 25 in 2013.

What happens this time. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. The maximum rate on long-term capital gains was again increased in 2013.

The 1987 capital gains tax collections were slightly below 1985. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect.

Today youll find our 431000 members in 130 countries and territories representing many areas of practice including business and industry public practice government education and consulting. Ii The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. Dems eye pre-emptive capital gains effective date.

With tax writers launching mark-ups as early as Sept. Note the proposed retroactivity of the LTCG rate hike. Iii From a top individual rate of 882 to rates ranging from 965 to 109.

A notable exception being the taxation at ordinary rates for long term capital gains and qualified dividends for taxpayers with incomes in excess of 1 million this change will become effective after the date of announcement according to the treasury budget. The effective date for this increase would be September 13 2021. The proposal would increase the maximum stated capital gain rate from 20 to 25.

If this were to happen it may not. That reference is to april 28 2021 when the proposal was announced in president. Since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. We are the American Institute of CPAs the worlds largest member association representing the accounting profession. It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning.

June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. This resulted in a 60 increase in the capital gains tax collected in 1986. The current estimate of that effective date ranges from October 15 2021 on the early.

The NYC rate remained at 3876. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Increase the top ordinary income tax rate to 396 from 37 effective Jan.

The effective date for this increase would be september 13 2021. 27 deadline there could be imminent action triggering an effective date tied to an upcoming date. 9 and racing against a Sept.

1 2022 but certain provisions may have proposed effective dates tied to the date of announcement committee action or enactment. The proposed effective date is for taxable years beginning after december 31 2021. As of 2021 the lifetime gift tax exclusion is 117 million per individual and 234 million per married couple.

The House bill would apply the increase to gain recognized after September 13 2021. If adopted this proposal would likely be. Our history of serving the public interest stretches back to 1887.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. 1 2022 and the top long-term capital gains tax rate to 25 from 20generally effective for gain realizations after Sept. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate.

Whereas under the Green Book proposal that same 10 million gift would trigger 1632000 in capital gains tax assuming that none of the 1 million exclusion had previously been used 5 million of gain minus 1 million of. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. More than five months ago.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

How Capital Gains Affect Your Taxes H R Block

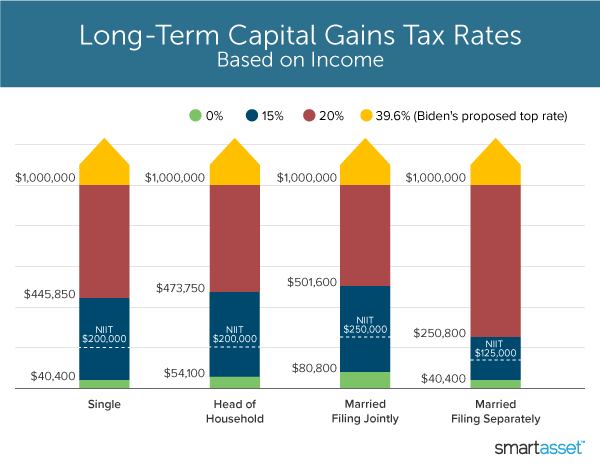

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax What Is It When Do You Pay It

Hellotax App Increases Efficiency And Effectiveness Of The Income Tax Return Filing Process Hellotax Hellotaxapp Itr Income Tax Return Tax App Tax Return

Capital Gains 101 A Simple Guide To Understanding A Complicated Tax Code Mint Com Blog Capital Gain Career Motivation Coding

Harpta Maui Real Estate Real Estate Marketing Maui

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Tax Advantages For Donor Advised Funds Nptrust

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

This Is Exactly How I Passed Principles Of Tax In A Month Sophie Winter Revision Guides How To Memorize Things Principles

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)